income tax calculator philippines

P25000 P58130 P31250 P100. The general rate of VAT in The Philippines is 12 though some items are rated at 0.

Tax Calculator Compute Your New Income Tax

Counties cities and districts impose their own local taxes.

. DA sets massive P25 trillion plan to modernize Philippine agriculture - Philippine Star. Tax Calculator Philippines This will calculate the semi-monthly withholding tax as well as the take home pay. Interest of PHP 20000 on peso bank account.

Income Tax Calculator Philippines Who are required to file income tax returns. This income tax calculator can help estimate your average income tax rate and your salary after tax. Amendments to NIRC.

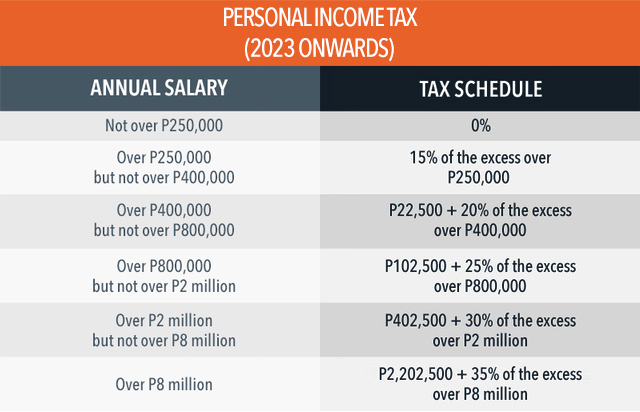

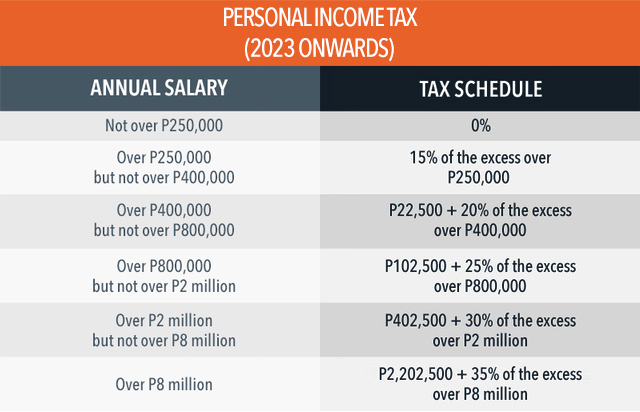

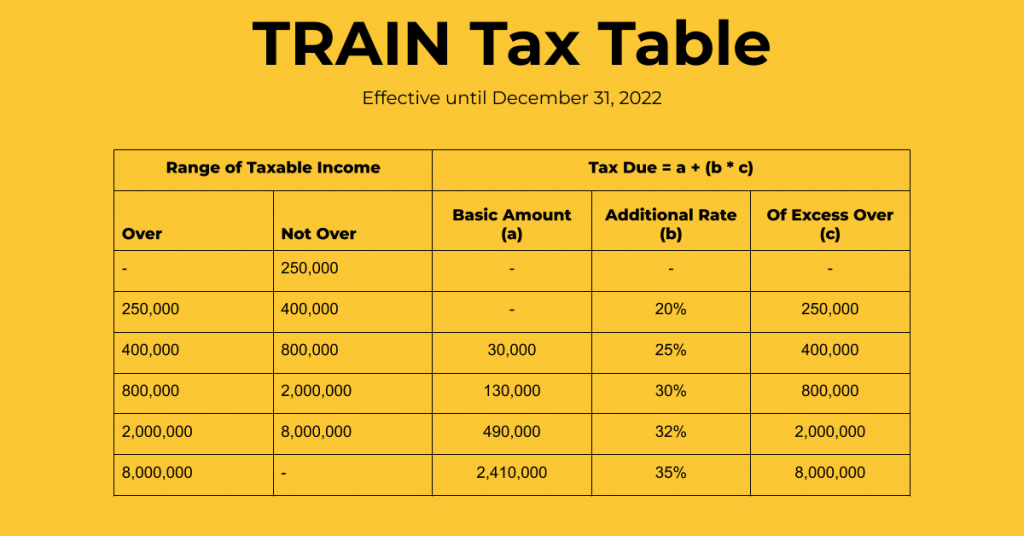

The current tax table is relatively simpler and allows employees to take. Income tax for Philippines is the individual income tax consists of taxes on compensation income from employment business income and passive income interests dividends royalties and. The compensation income tax rate in The Philippines is progressive and ranges from 0 to 35 depending on your income.

Heres how it is computed. Using your taxable income compute your income tax by referring. NTRC Tax Research Journal.

Inputs are the basic salary half of monthly salary deductions other allowances and overtime in hours. United States Sales Tax. How many income tax brackets are there in The Philippines.

VAT is a value added sales tax used in The Philippines. See California Texas Florida New York Pennsylvania etc. Tax computation in the Philippines changed this January 2018 in the form of the Tax Reform Bill of the Duterte Administration.

Private Government Does your spouse work for. Salary of PHP 652000 living allowances of PHP 100000 and housing benefits 100 of PHP 300000. Sweldong Pinoy is a salary calculator for Filipinos in computing net pay withholding taxes and contributions to SSSGSIS PhilHealth and PAG-IBIG.

Call center employee with a gross monthly salary of Php 20000 receiving 13th-month pay of the same amount earning Php 15000 monthly as a freelance photographer and availed of the 8 tax rate on business income. Philippine Public Finance and Related Statistics 2017. The Annual Wage Calculator is updated with the latest income tax rates in Philippines for 2020 and is a great calculator for working out your income tax and salary after tax based on a Annual income.

Tax Calculator Philippines is an online calculator you can use to easily compute your income tax and other miscellaneous expenses that comes with it. Use the calculator below to find values with and without VAT. There is base sales tax by most of the states.

Sales Tax in US varies by location. Calculate United States Sales Tax. The Tax tables below include the tax rates thresholds and allowances included in the Philippines Tax Calculator 2023.

An Income Tax Calculator is an online tool you can use to assess your tax liability as per the relevant tax laws. Multiply the difference by 8 to compute the income tax due. This calculator was originally developed in Excel spreadsheet if you wish to get a copy please subscribe to our Youtube channel.

Accordingly the withholding tax due computed by the calculator cannot be used as basis of complaints of employees against their employers. New Tax Reform Calculator in the Philippines Want to know how much youre going to be earning with the tax reform. The income tax system in The Philippines has 6 different tax.

Teaching salary of wife. Tax Changes You Need to Know on RA 10963 TRAIN 2017 Philippine Capital Income and Financial Intermediation Statistics. This tool is built so more Filipinos are more aware of the salary or monthly income tax they are paying.

This tool is built so more Filipinos are more aware of the salary or monthly income tax they are paying. Gross dividend income from investment in shares of stock of a domestic corporation of PHP 10000. Where Does Your Tax Money Go.

The Annual Wage Calculator is updated with the latest income tax rates in Philippines for 2022 and is a great calculator for working out your income tax and salary after tax based on a Annual income. The application is simply an automated computation of the withholding tax due based only on the information entered into by the user in the applicable boxes. Check out our tool below Lets Begin.

Weeks before Duterte gone PH gets P29B loan for bridges - Philippine Daily. NTRC Tax Research Journal. No validation process is being performed on the.

Compute for the Income Tax. Salary and allowances of husband arising from employment. Good thing that there are online tax calculators available in the Philippines to make everything easier for you.

The calculator is designed to be used online with mobile desktop and tablet devices. We are aiming to give you the precise computation as possible but as you have known tax. Total income tax -12312.

Just enter the Gross or Nett value and it will calculate the rest for you. Php 230000 x 008 Php 18400. Income tax law provided in Tax Code of 19997 governs income tax procedures in Philippines resident citizens receiving income from sources within and outside Philippines fall under income tax category use this online calculator to calculate your taxable income.

Need more than a calculator. Philippines Annual Salary After Tax Calculator 2020. Single Married 2Do you work for.

How To Compute Your Income Tax Using Online Tax Calculator An Ultimate Guide Filipiknow

Table Take Home Pay Under 2018 Tax Reform Law

How To Calculate Income Tax In Excel

Calculating Individual Income Tax On Annual Bonus In China Updates Dezan Shira Associates

Provision For Income Tax Definition Formula Calculation Examples

Income Tax Calculation Formula With If Statement In Excel

Tax Calculator Compute Your New Income Tax

How To Calculate Your 2013 Expatriate Individual Income Tax In China China Briefing News

How To Calculate Foreigner S Income Tax In China China Admissions

How To Compute Quarterly Income Tax Return Philippines 1701q Business Tips Philippines

How To Create An Income Tax Calculator In Excel Youtube

Tax Calculator Philippines 2022

2022 Bir Train Withholding Tax Calculator Tax Tables

Excel Formula Income Tax Bracket Calculation Exceljet

Income Tax Tables In The Philippines 2022 Pinoy Money Talk

2022 Bir Train Withholding Tax Calculator Calculator

Tax Calculator Compute Your New Income Tax

How To File Your Annual Itr 1701 1701a 1700 Updated For 2021